A heartbreaking incident unfolded when six-year-old Lucy Morgan lost her life in a freak badminton accident. As she swung the racket downward, a piece of metal from the handle broke off and pierced her skull, causing severe injuries. This tragic accident occurred while Lucy and her family were on vacation in Limerick, Maine.

Lucy’s father, Pastor Jesse Morgan, shared the heartbreaking details on his blog. He recounted how, despite being unresponsive, Lucy was still breathing on her own after the metal piece struck her.

She was rushed to the nearest hospital and then airlifted to Maine Medical Center in Portland. There, she underwent an operation to relieve pressure and address her injury, but the doctors explained that the chances of her recovery were minimal.

In a poignant revelation, Jesse shared that Lucy had spoken about meeting God just a month before the accident. She had asked her mom about being “saved,” and after a brief conversation, she went to her room to pray. Jesse wrote, “She went to her room and prayed to God to forgive her and that she believed in Jesus’ death and resurrection. What a gift.”

Jesse offered updates on Lucy’s condition, sharing the devastating news of her worsening brain function. Despite the medical personnel’s best efforts, Lucy’s injuries proved to be too extensive. Sadly, Lucy Lynn Morgan passed away the following morning at 4 am. Jesse expressed his gratitude for the outpouring of love and support from friends and family during this difficult time.

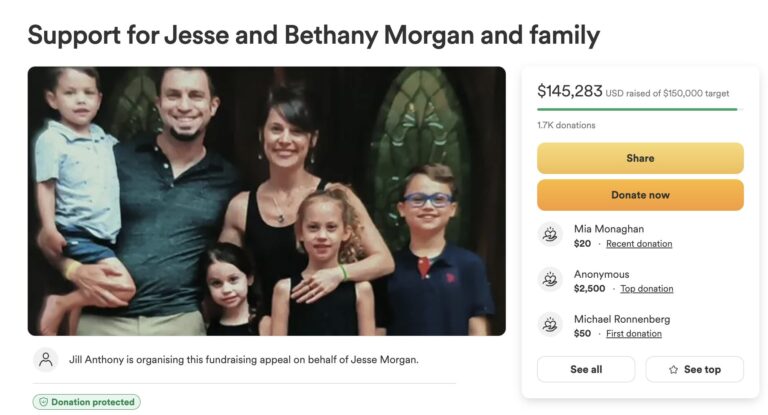

To help the grieving family, loved ones established a GoFundMe campaign that has surpassed its initial goal of $100,000. The funds raised will aid in covering expenses for meals while they are away from home, lodging for family members, and medical costs. The overwhelming response to the campaign is a testament to the love and compassion that people have shown towards the Morgans.

We extend our deepest sympathies to the Morgan family for their tragic loss. May Lucy rest in peace, and may the family find comfort in the love and support surrounding them.

[other]

Renting an apartment can be a daunting task, especially if you have a low credit score. However, with the right strategies and a little persistence, it’s possible to secure your dream rental, even with less-than-perfect credit. This comprehensive guide will provide you with practical tips and insider knowledge to help you navigate the rental process successfully.

Understand Your Credit Score

Understanding the basics of your credit score is the first step in navigating the rental process, especially if you have a low credit score. A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850, with a higher score indicating a lower risk to lenders. This three-digit number is determined by various factors, including your payment history, credit utilization, length of credit history, and the types of credit you’ve used.

What is a Credit Score?

Your credit score is a crucial factor that landlords consider when evaluating your rental application. It provides a snapshot of your financial responsibility and the likelihood that you’ll make timely rent payments. Lenders and landlords use this score to assess the risk of doing business with you, so it’s essential to understand what it means and how it’s calculated.

Factors Affecting Your Credit Score

Your credit score is influenced by several key factors, such as your payment history, credit utilization, length of credit history, and the types of credit you’ve used. Paying your bills on time, keeping your credit card balances low, and maintaining a diverse credit mix can all contribute to a higher credit score. Conversely, late payments, high credit card balances, and a limited credit history can negatively impact your score.

Checking Your Credit Report

Before applying for a rental, it’s crucial to check your credit report and address any errors or discrepancies. Your credit report contains detailed information about your credit history, including your payment patterns, credit accounts, and any negative items that may be affecting your score. By reviewing your report and addressing any issues, you can ensure that your credit information is accurate and up-to-date, which can improve your chances of securing the rental you desire.

Prepare Your Rental Application

As you embark on the journey of renting an apartment, it’s crucial to have your rental application meticulously prepared. This is your chance to showcase your qualifications and address any concerns the landlord may have about your credit situation. Start by gathering all the required documents, such as pay stubs, bank statements, and references, to demonstrate your financial stability and reliability as a potential tenant.

Gather Required Documents

Assembling the necessary paperwork is the first step in presenting a compelling rental application. Ensure you have the following documents at the ready:

- Recent pay stubs or proof of income

- Bank statements showcasing your savings and spending habits

- Letters of recommendation from previous landlords or employers

- Identification documents, such as a driver’s license or passport

Explain Your Credit Situation

When it comes to your credit situation, honesty is the best policy. Be upfront with the landlord about any factors that may have contributed to a low credit score, such as medical bills, job loss, or unexpected financial challenges. Highlight the positive steps you’ve taken to improve your financial standing, such as paying down debts, building an emergency fund, or increasing your credit limit. This transparency can go a long way in demonstrating your commitment to being a responsible tenant.

| Document | Purpose |

|---|---|

| Pay Stubs | Demonstrate stable income and employment history |

| Bank Statements | Show financial responsibility and savings habits |

| Identification | Verify your identity and legal status |

| Recommendation Letters | Highlight your positive rental history and character |

Build a Solid Rental History

If you have a limited or poor rental history, building a strong renting tips can work in your favor. Maintain a positive relationship with your current or previous landlords, pay rent on time, and keep the property well-maintained. A solid rental history demonstrates your reliability as a tenant and can help offset the concerns a landlord may have about your credit score.

One effective way to establish a positive rental history is by being a responsible and attentive tenant. Communicate openly with your landlord, address any issues promptly, and treat the property with the utmost care. By proving your commitment to being a reliable renter, you can convince potential landlords that your credit score does not accurately reflect your ability to fulfill your rental obligations.

Additionally, consider requesting a letter of recommendation from your previous landlord. This can provide valuable insight into your renting habits and serve as a testament to your trustworthiness as a tenant. Presenting this documentation along with your rental application can help bridge the gap between your credit score and your actual renting experience.

Offer a Larger Security Deposit

If your credit score is a concern for the landlord, consider offering a larger security deposit. This shows your commitment to the rental and can ease the landlord’s worries. You can also try negotiating with the landlord, highlighting your strengths as a tenant and explaining how you plan to be a responsible and reliable renter.

Negotiate with the Landlord

When negotiating with the landlord, be prepared to showcase your positive rental history, stable employment, and any other factors that demonstrate your reliability as a tenant. Emphasize your willingness to be a responsible renter and your understanding of the landlord’s concerns regarding your credit score.

Consider a Co-Signer

Additionally, having a co-signer with a strong credit history can help strengthen your rental application. This option provides the landlord with an additional guarantee that the rent will be paid on time, even if you encounter financial difficulties. Carefully choose a co-signer who is willing to take on this responsibility and has a credit profile that will impress the landlord.

Stay Positive and Persistent

Renting an apartment with a low credit score can be a challenging task, but don’t let it discourage you. Remember, your credit score doesn’t define your worth as a tenant. With a positive attitude and strategic approach, you can overcome this hurdle and find the perfect rental that suits your needs.

Understanding the Importance of Credit Score

Your credit score is a crucial factor in the rental process, as it helps landlords assess your financial responsibility and ability to make timely payments. However, it’s important to understand that a low credit score doesn’t automatically disqualify you from securing a rental. Landlords often consider a range of factors, including your overall financial situation, rental history, and the reasons behind your credit challenges.

Strategies to Improve Your Credit Score

While improving your credit score takes time and effort, there are several strategies you can employ to enhance your creditworthiness. Start by reviewing your credit report, identifying any errors or discrepancies, and addressing them promptly. Develop a plan to pay down outstanding debts, maintain low credit utilization, and establish a consistent history of on-time payments. By taking proactive steps to improve your credit score, you’ll increase your chances of finding the perfect rental, even with a less-than-ideal credit score.

Remember, renting an apartment with a low credit score is not an impossible task. Stay positive, be persistent, and focus on showcasing your strengths as a potential tenant. With the right approach and a little determination, you can overcome this hurdle and secure the rental of your dreams.

FAQ

Can I rent an apartment with a low credit score?

Absolutely! While a low credit score can present challenges, it’s certainly possible to rent an apartment, even if your credit isn’t perfect. It just takes a bit more effort and creativity to showcase your strengths as a tenant.

How can I explain my credit situation to a landlord?

The key is to be upfront and honest about your credit situation. Provide a clear explanation for any negative items on your credit report, and highlight any positive changes or steps you’ve taken to improve your financial situation. Landlords appreciate transparency, and this can go a long way in building trust.

What documents do I need to prepare for the rental application?

Gather all the necessary documents, such as pay stubs, bank statements, and references. This shows the landlord that you’re organized and serious about the rental. Be sure to also have a copy of your credit report handy to address any concerns the landlord may have.

How can I build a strong rental history?

Maintaining a positive relationship with your current or previous landlords is key. Pay rent on time, keep the property well-maintained, and document any interactions with the landlord. A solid rental history demonstrates your reliability as a tenant and can help offset concerns about your credit score.

Should I offer a larger security deposit?

Offering a larger security deposit is a great way to show the landlord your commitment to the rental. This can ease their concerns about your credit score and make your application more appealing. You can also try negotiating with the landlord, highlighting your strengths as a tenant and explaining how you plan to be a responsible renter.

What if I don’t have a co-signer?

If you don’t have a co-signer with a strong credit history, don’t worry. There are other strategies you can use, such as offering a larger security deposit or demonstrating a solid rental history. Stay positive and persistent, and you’ll increase your chances of finding the perfect rental, even with a low credit score.